Investment management services

Our philosophy

We employ a dynamic investment approach: Financial Markets are constantly in motion. Consequently, we strongly believe that a successful investment approach should be flexible at any time. Pursuing a dynamic investment approach does not mean we continuously trade your portfolio holdings (e.g. "churning"), neither do we require you to have a long-term investment horizon.

We offer a tailor-made service: As a lean boutique-style organisation, we are not required to use our investment management services as a distribution channel for our allocation of pre-defined financial products. Instead, we are able to offer a tailor-made service whose only aim is to serve your personal requirements. Our independence is your guarantee that we always strive to choose the most suitable investments for you as our client.

We have cross-asset class expertise: Based on our in-depth experience in financial markets and our select broad network within the investment community, we cover all major asset classes, financial instruments and products. With us you benefit from an exclusive single point of contact for all type of investment management services.

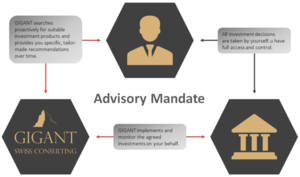

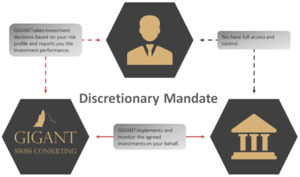

We distinguish between the following two types of services:

Active Advisory Investment Management

All investment decisions are taken by yourself. Based on your risk profile we provide you with regular investment advice on implementation of the most promising asset allocation. We proactively search our market universe for suitable investment products and regularly provide specific, tailor-made recommendations. Furthermore, we implement and continuously monitor agreed investments on your behalf.

Discrectionary Investment Management

Based on your risk profile Gigant takes the investment decisions on your behalf in order to best meet your pre-defined investment goals. We tactically modify your asset allocation within a given set of risk-reward ranges and select for you the best suited investment products. Together with you we regularly review your portfolio as well as the achieved investment performance. Within the framework of our discretionary investment offering, we gladly offer performance-fees instead of fixed fee models on request.